Nvidia Earnings

Nvidia, a global leader in AI and graphics processing technology, has once again caught the attention of investors as it approaches its next earnings report. With the company’s stock already having a blockbuster year, there’s significant anticipation in the market about what Nvidia’s financial results might reveal. In particular, the options market is showing signs that traders are expecting considerable movement in Nvidia’s stock following the earnings release.

Nvidia’s Position in the Market

Nvidia has been riding a wave of success, particularly due to its dominance in the AI sector. The company’s graphics processing units (GPUs) are not only integral to gaming but have become essential components in AI infrastructure, enabling the rapid training of machine learning models. This dual-market appeal has made Nvidia a standout player in the tech industry, with its stock reflecting this strong position. Over the past year, Nvidia’s share price has soared, driven by increasing demand for AI-related technologies and robust sales in its data center segment.

we have alreday talked about Nvia’s skyrocketing CAP on an previous article Click here

Expectations for the Nvidia Earnings Report

The upcoming earnings report is generating a significant buzz. Analysts and investors are keen to see whether Nvidia can sustain its impressive growth trajectory. The consensus expectation is for Nvidia Earnings report strong revenue and profit figures, buoyed by continued demand for its high-performance GPUs. However, what makes this earnings season particularly interesting is the behavior of the options market.

The options market can often provide insight into how traders are positioning themselves ahead of major corporate events like earnings announcements. For Nvidia, there has been a noticeable increase in options trading volume, particularly in contracts that bet on significant stock price movement. This suggests that traders are preparing for a potentially volatile reaction to Nvidia’s earnings report, either upward or downward.

Why the Options Market is Excited

There are a few reasons why the options market is expecting such movement. Firstly, Nvidia’s stock has already seen substantial gains this year, leading some to wonder if it might be due for a correction if the earnings report fails to meet high expectations. On the other hand, if Nvidia exceeds these lofty expectations, the stock could surge even higher, rewarding those who are betting on continued growth.

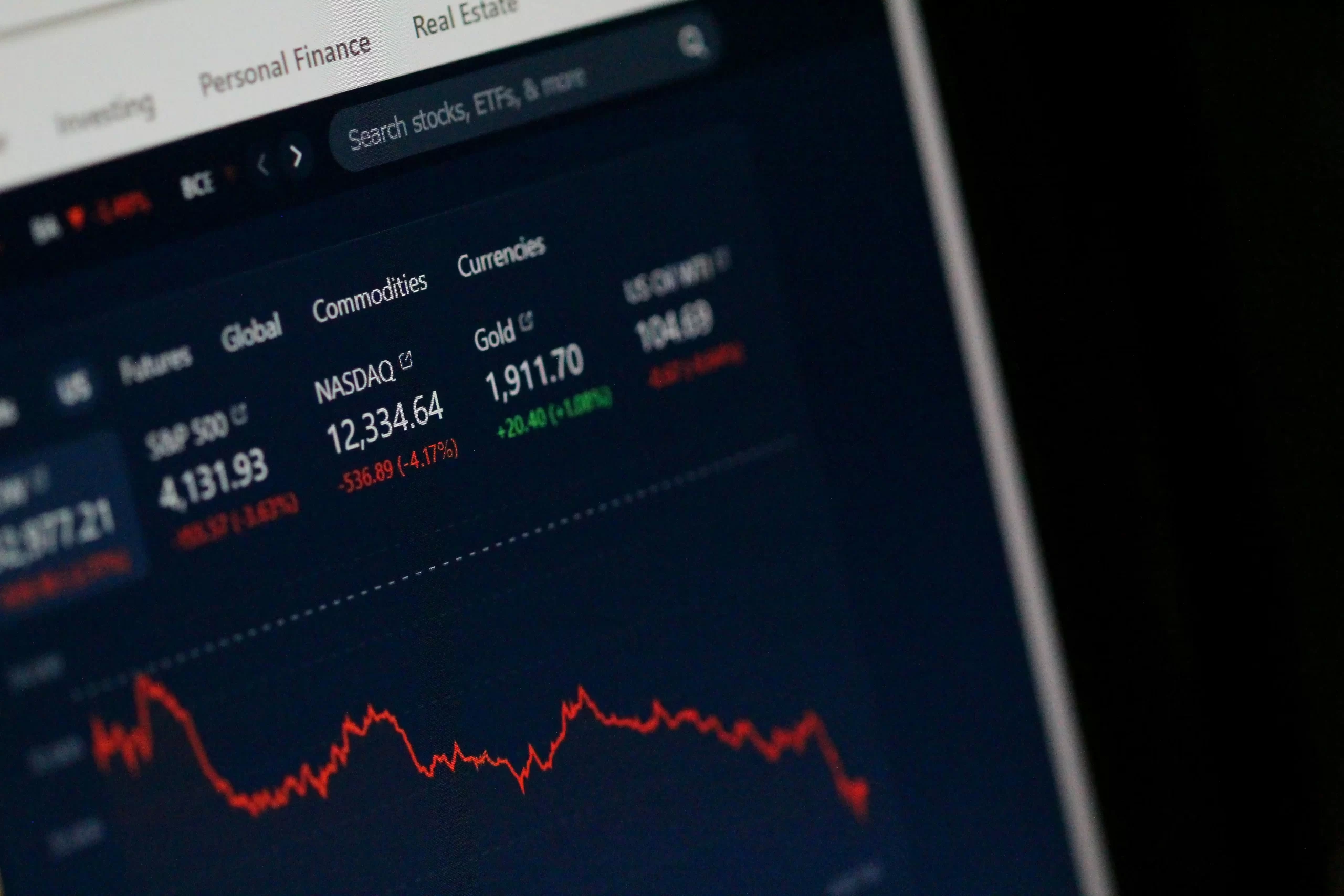

Secondly, the broader market context is also contributing to the heightened anticipation. The tech sector as a whole has been under pressure due to concerns about rising interest rates and their impact on high-growth companies. Nvidia, despite its strong fundamentals, is not immune to these macroeconomic factors. Therefore, the options market might be reflecting uncertainty about how these broader issues will impact Nvidia’s stock in the near term.

Potential Outcomes and Investor Sentiment

Investors are facing a classic dilemma: whether to ride the wave of Nvidia’s success or to take a more cautious approach given the elevated risk of a market correction. If Nvidia’s earnings report shows continued strength in its AI and gaming divisions, and if its guidance for the future is optimistic, the stock could break through to new highs. Conversely, if there’s any sign of slowing growth or if the company issues cautious guidance, the stock could experience a pullback.

The options market’s activity suggests that traders are hedging their bets. By purchasing options, they can position themselves to profit from significant moves in either direction without having to commit large sums of capital upfront. This strategy is particularly appealing in a situation like this, where the potential for volatility is high.

Conclusion

As Nvidia approaches its earnings announcement, all eyes are on how the company will perform and how its stock will react. The heightened activity in the options market indicates that traders are bracing for significant movement, reflecting both the potential rewards and risks associated with investing in Nvidia at this juncture. Whether you’re an investor in Nvidia or simply an observer of the market, this earnings season promises to be an exciting one, with Nvidia once again at the center of attention.