Record-Breaking Earnings for Q2 2024

Nvidia’s recent financial results have been impressive, with the company reporting a record $30 billion in revenue for Q2 2024. This surge is largely attributed to the growing demand for Nvidia’s AI chips and Nvidia Stock, which have become essential in various industries. The company has consistently outperformed market expectations, further solidifying its position as a leader in the tech sector.

We wrote more abou Nvidia Stock CLICK HERE

Market Reaction: The “Sell the News” Phenomenon

Despite these strong financials, Nvidia Stock Decline: A Closer Look at Recent Trendsexperienced a 7% decline. This drop can be attributed to the “sell the news” phenomenon, where investors sell off shares even after positive earnings reports. The reasoning behind this is that the stock price may have already factored in the good news, leaving limited room for further gains. Nvidia’s stock, which has seen significant growth throughout 2024, appears to be a prime candidate for profit-taking in this scenario.

Broader Market Volatility and Its Impact on Nvidia Stock

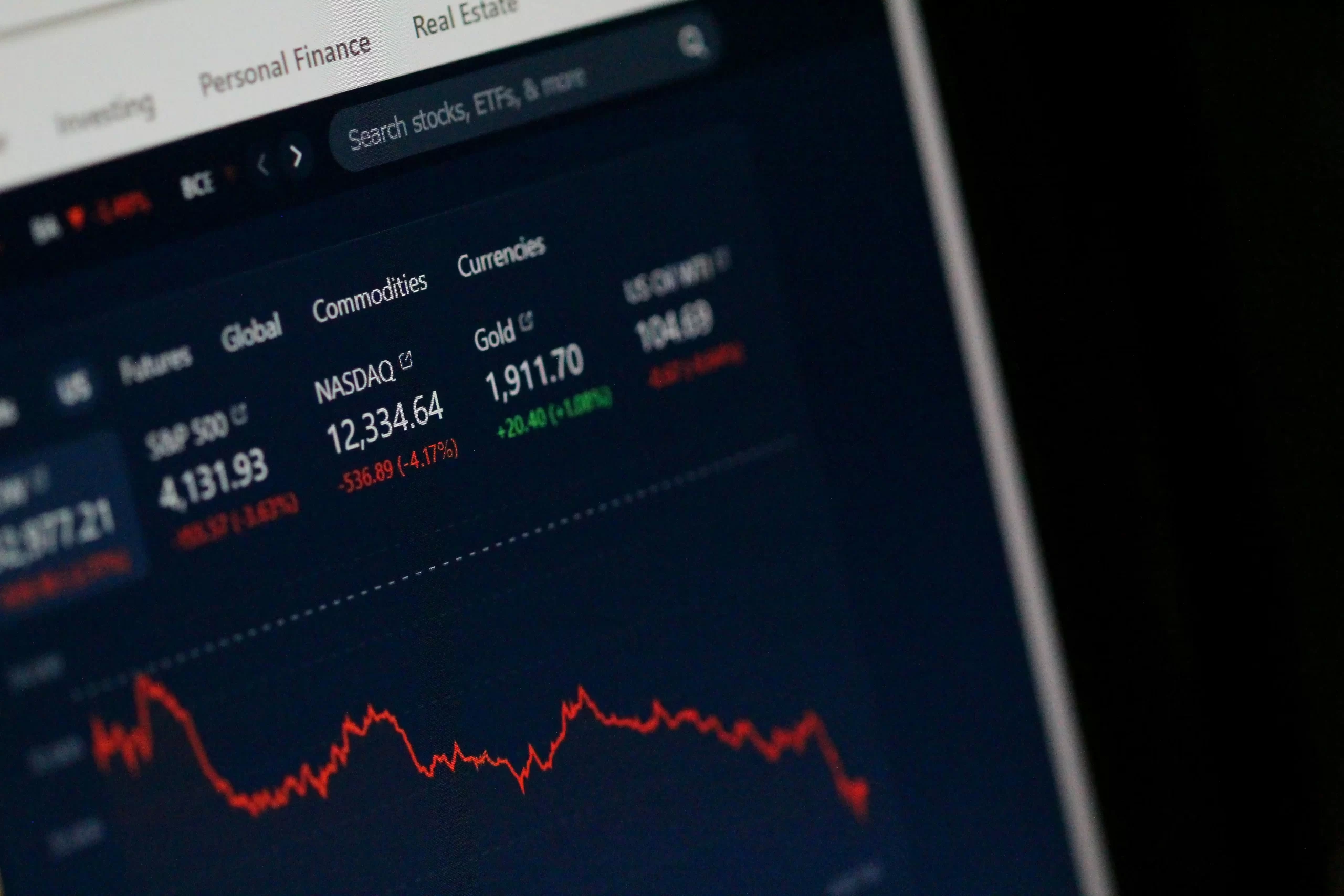

The decline in Nvidia’s stock comes amid broader market volatility, particularly in the tech sector. The Nasdaq and other major indices have shown signs of weakness, with many analysts predicting a potential market correction. Nvidia’s high valuation makes it more susceptible to sharp declines when investor sentiment shifts, further contributing to its recent stock performance.

Macro Economic Concerns: A Cloud Over Tech Stocks

The macroeconomic environment is also playing a role in Nvidia’s stock decline. Concerns about interest rates, inflation, and economic growth are making investors more cautious. The Federal Reserve’s policies, especially any hints of interest rate adjustments, are closely watched as they have significant implications for tech stocks like Nvidia. While the company’s earnings remain strong, these broader concerns are creating a challenging environment for its stock.

Industry Developments: Ripple Effects on Nvidia

Recent news from other tech companies, such as Super Micro Computer, has added to the uncertainty surrounding Nvidia’s stock. As a key player in the AI and tech space, Nvidia is closely tied to industry developments. Negative news affecting one company can quickly impact others, contributing to the volatility observed in Nvidia’s stock price.

The Road Ahead: Opportunities and Challenges for Nvidia

Looking forward, Nvidia’s stock faces a mix of opportunities and challenges. The company’s leadership in AI positions it well for future growth, with the continued expansion of AI applications likely to sustain demand for its products. However, the stock’s high valuation and potential macroeconomic headwinds suggest that volatility may persist.

Conclusion: Navigating Nvidia’s Stock in a Volatile Market

In summary, Nvidia’s recent stock performance reflects the complexities of investing in high-growth tech companies during volatile market conditions. While the company’s financials are strong, broader market dynamics and investor sentiment have introduced uncertainty. Investors should weigh both the opportunities and risks associated with Nvidia stock as they make their investment decisions.